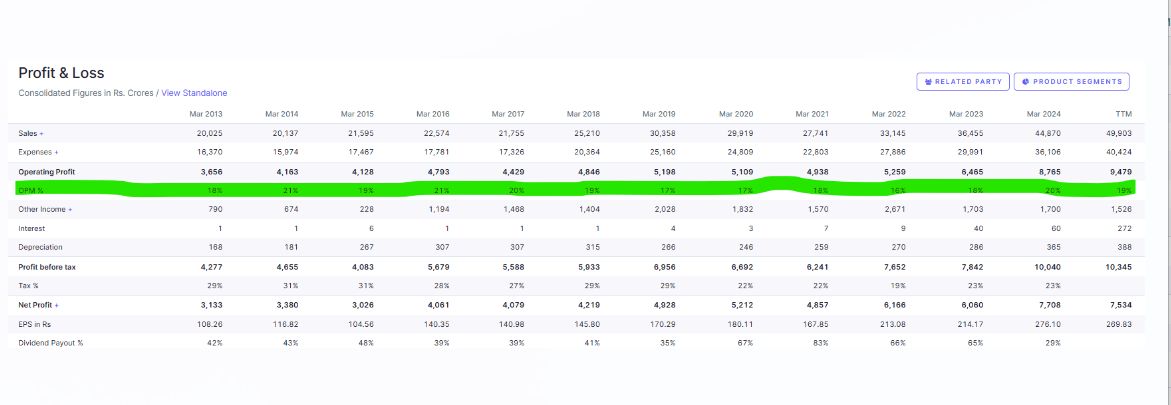

Bajaj Auto’s Margin Mastery: How Strategic Agility Sustains 20% Profitability Amid Challenges

Bajaj Auto’s ability to maintain operating margins of around 20% over the past decade is one of the standout aspects of its business. This stability has turned its operating margin into a key metric closely tracked by analysts and investors.

Consistent profitability, despite market fluctuations, cost pressures, and industry transitions such as the EV shift, underscores Bajaj Auto’s strong financial discipline and strategic execution. The company’s ability to protect margins while expanding in domestic and international markets has enhanced investor confidence, making it a preferred stock in the auto sector.

Analysts view margin stability as reflecting Bajaj Auto’s pricing power, cost efficiency, and premium product positioning, reinforcing its reputation as a financially robust and resilient player in the two-wheeler and three-wheeler segments.

Strategies for Sustaining Margins:

Product Mix Optimization: Bajaj Auto has focused on selling higher-margin products, such as premium motorcycles and three-wheelers. In the quarter ending June 30, 2024, sales in the premium 125cc-400cc motorcycle segment, including the Pulsar range, surged by 38%, contributing to a rise in the core profit margin to 20.2% from 19% the previous year.

Export Market Focus:

The company has a strong presence in international markets, with exports accounting for a significant portion of its revenue. In the quarter ending September 30, 2024, exports rose by 5.4%, contributing to an overall revenue increase of 21.8% to ₹131.27 billion.

Cost Management:

Bajaj Auto has implemented judicious price increases, better foreign exchange realization, and favorable product mix to offset material cost inflation. In Q1 FY23, these measures led to an 8% year-over-year increase in revenue and a 100 basis points improvement in EBITDA margin, despite supply constraints and cost headwinds.

Challenges Faced:

Domestic Market Fluctuations: The company has experienced declines in domestic sales. In Q3 2024, domestic sales decreased by 9% year-over-year, with 707,105 units sold compared to 778,281 units in Q3 2023.

Rising Input Costs:

Increased costs of raw materials have posed challenges. However, Bajaj Auto’s strategic pricing and cost management have helped mitigate these impacts.

Electric Vehicle (EV) Segment:

The foray into electric scooters, which typically have lower margins, has impacted profitability. In Q3 2024, higher sales of lower-margin electric scooters contributed to a smaller-than-expected profit.

In summary, Bajaj Auto’s sustained operating margins are the result of strategic initiatives in product offerings, market expansion, and cost control, enabling the company to navigate revenue and cost challenges effectively.